HDFC Bank Personal Loan : Need money fast? HDFC Bank has got you covered with their online personal loan option. If you are already a customer of the bank, the process of getting a loan is easier. You can get a loan of up to Rs 50,000 in just 10 seconds without leaving your home. All you need to do is apply online for a loan from the comfort of your own living room.

HDFC Bank Personal Loan

To apply for, you must meet certain eligibility criteria. In this article, we have provided you with all the information you need, including how to apply and the required requirements. So, if you meet the eligibility criteria, you can easily submit your application and get the funds you need.

Want to apply for a loan? HDFC Bank offers personal loans both online and in person. Applying online is quick and convenient and can help you avoid any potential mistakes. You can apply for a loan of up to ₹50,000 through the online platform.

If you are not comfortable with applying online, you can visit your nearest HDFC Bank branch to speak to a representative. Either way, HDFC Bank offers you a quick and easy way to get the funds you need.

Important Details

| Loan Name | HDFC Personal Loan |

| Bank Name | HDFC Bank |

| Loan amount | Rs 50,000/- to Rs 40,00,000/- |

| Interest rate | 11% to 21% p.a |

| Loan Repayment Timing | 12 to 60 Months |

આ પણ વાંચો : 💥

HDFC Bank Scholarship (Rs 15,000 to 75,000/-)

Eligibility for HDFC Personal Loan

- Be between 21 to 60 years of age

- Be working in a company or government office

- Have a minimum monthly salary of ₹25,000

- Working continuously for last 2 years with 1 year in present company

Important Document

- Proof of Identity: Aadhaar Card, Voter Identity Card, Passport or Driving License

- Proof of Residence: House Certificate

- Bank statements of last 3 to 6 months

- Salary slip from last 2 consecutive months and Form 16

Method of taking

- Go to the official website of HDFC Bank.

- Click on the “Borrow” link.

- Select the “Paperless Loan” option.

- Fill the online form by giving your registered mobile number and date of birth.

- An OTP will be sent to your mobile, which you will enter on the website.

- Select your loan type and amount. Provide required document information.

- Submit the form.

- Your documents will be verified by the system, and if approved, you will receive a loan of up to ₹50,000 within 10 seconds.

Key points related to HDFC Personal Loan

HDFC Personal Loan can be availed within 10 seconds if you are a customer of the bank, otherwise it may take up to 4 days for the loan to be approved after verifying your details. The interest rate for the loan can be up to 11% and a processing fee of ₹4999 will be required.

Important Link

| Apply For Loan | Click Here |

| Home Page | Click Here |

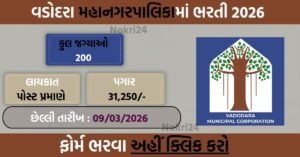

- VMC Recruitment 2026 – 200 Assistant Engineer And Work Assistant Vacancies

- GSSSB Recruitment 2026 – Staff Nurse (Ayurved) And Physiotherapist Posts (Special Drive for Divyang)

- SBI SCO Recruitment 2026 – 116 Specialist Officer Vacancies Announced

- AMC Sahayak Staff Nurse Recruitment 2026 – 26 Posts for Divyang Candidates

- Gujarat University Teaching Recruitment 2026 – Apply for Assistant And Associate Professor Posts