PNB E Mudra Loan : Is a financial product offered by Punjab National Bank (PNB) that helps small businesses and entrepreneurs get affordable credit. The loan is disbursed under the Pradhan Mantri Mudra Yojana (PMMY), a government scheme aimed at providing financial support to small businesses in India and encouraging entrepreneurship.

To be eligible for a PNB E Mudra loan, you must be a PNB account holder and have your Aadhaar card linked to your mobile number. You can apply for a loan online through the PNB website by following the steps mentioned above.

PNB E Mudra Loan

PNB E Mudra Loan is a financial product offered by Punjab National Bank (PNB) that helps small businesses and entrepreneurs get affordable credit. The loan is disbursed under the Pradhan Mantri Mudra Yojana (PMMY), a government scheme aimed at providing financial support to small businesses in India and encouraging entrepreneurship.

About Loan

The loan amount under PNB E Mudra Yojana can range from INR 50,000 to INR 10 lakh depending on your business needs and repayment capacity. Loans can be used for various purposes including equipment, raw materials and other business-related expenses. The loan repayment tenure can range from 1 to 5 years, and the interest rate is determined based on the loan amount, repayment term and the creditworthiness of the borrower.

PNB E Mudra Loan is a useful financial product for small businesses and entrepreneurs who are looking for affordable credit to grow their business. By applying online, you can easily and conveniently get a loan and get the financial support you need to achieve your business goals.

Important Details

| Loan Name | PNB E Mudra Loan |

| Bank Name | Punjab National Bank |

| Loan amount | Rs 50,000/- to Rs 10,00,000/- |

| Interest rate | As per rules |

| Loan Repayment Timing | 1 Year to 5 Years |

Read This also

SBI Scholarship for students ( Rs 10,000/-)

Apply Steps

- Visit the PNB website and navigate to the E Mudra Loan page.

- Click on the “Apply Now” button to start the application process.

- Fill the online application form with your personal and business details including information about your business and the loan amount you want.

- Upload the required documents.

- This can include proof of identity, proof of address, proof of occupation and financial documents.

- Review your application and submit it.

- Wait for a response from the lender.

- If your application is approved, you will receive details about the terms and conditions of the loan, including the loan amount and interest rate.

- Accept the loan offer and sign the loan agreement.

- Wait for the loan amount to be disbursed in your bank account.

Important Document

- Identity Proof:

- PAN Card

- Voter ID Card

- Passport

- Address Proof: This can be a voter ID card, passport or utility bill. Proof of business:

- This can include a copy of your GST registration certificate, tax return and business license.

- Financial documents: You will need to provide financial documents such as your bank statements, profit and loss statements and balance sheets.

- In addition to these documents, you may also be required to provide other information and documents as per the lender’s requirements.

- It is important to read the loan application process and requirements carefully before proceeding with the application.

Important

It is important to read and understand the terms and conditions of the loan carefully before accepting the loan offer. Be sure to ask any questions you may have before signing the loan agreement.

Important Link

| Apply For Loan | Click Here |

| Home Page | Click Here |

- GSSSB Supervisor Instructor Recruitment 2026 – Supervisor Instructor (Class-III) | 195 Vacancies (Special Drive for PwBD)

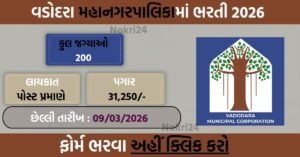

- VMC Recruitment 2026 – 200 Assistant Engineer And Work Assistant Vacancies

- GSSSB Recruitment 2026 – Staff Nurse (Ayurved) And Physiotherapist Posts (Special Drive for Divyang)

- SBI SCO Recruitment 2026 – 116 Specialist Officer Vacancies Announced

- AMC Sahayak Staff Nurse Recruitment 2026 – 26 Posts for Divyang Candidates